Key chemicals industry trends in 2026

How leading organizations are prioritizing the design and production of chemicals and materials that are better for our health, the environment and the economy.

Research indicates that innovators and green leaders in the chemicals industry are best placed to maintain competitive differentiation and value creation. In an analysis by McKinsey, chemical companies with greener product portfolios yielded higher total shareholder returns than companies with less sustainable product portfolios.

The urgency of reducing carbon emissions is driving rapid innovation in the chemicals industry, along with the need to maintain business viability amid economic and geopolitical unpredictability. These are four areas where chemicals and materials organizations are focusing to drive sustainability and continued growth.

Bio-based materials and feedstocks

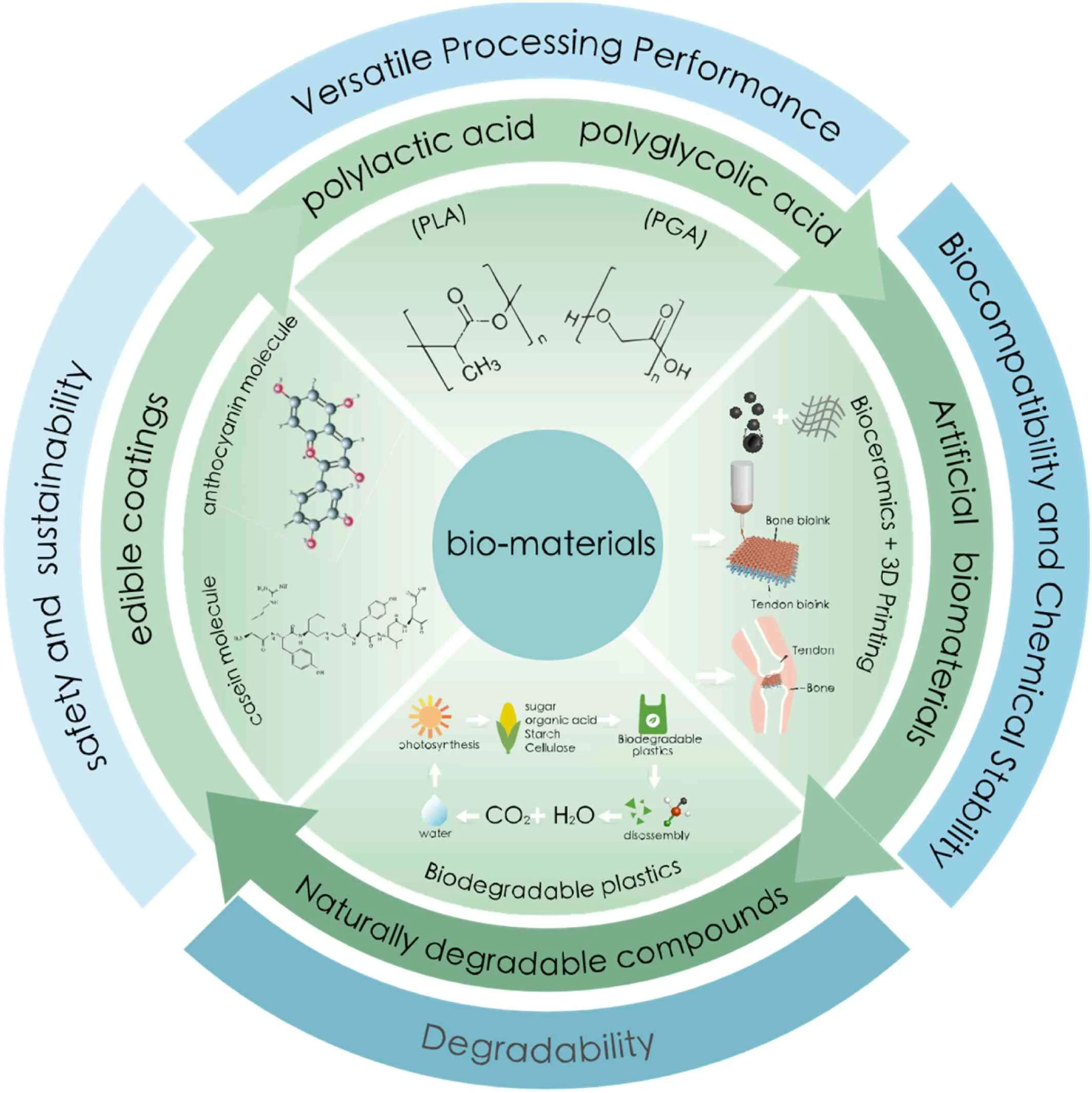

Bio-based materials are substances derived from living organisms, such as plants, animals, and microorganisms, rather than from fossil fuels or synthetic chemicals. These materials are renewable, biodegradable, and often have a lower environmental impact compared to traditional materials. Examples include bioplastics made from corn starch, natural fibers like cotton and hemp, and bio-based composites used in construction and packaging.

Bio-based materials, such as bioplastics, have become an area of significant interest in discussions around the future of materials. Demand is growing, and major organizations are using these materials to develop sustainable food packaging, more eco-friendly cosmetics, bio-based energy sources and more.

Watch free webinar: Exploring the Circular Economy in Chemicals and Materials

Food packaging is one area where these materials have seen real traction, despite challenges to widespread adoption. Materials such as polysaccharides, proteins and polyhydroxyalkanoates can be obtained from biomass and used in food packaging applications.

Schematic representation of the various types and properties of biomaterials. (Source: Chemical Engineering Journal Advances)

In the world of sustainable feedstocks, photosynthetic organisms like microalgae and cyanobacteria are seen as carbon-neutral, sustainable feedstocks as their cultivation does not require arable land, pesticides and agricultural machinery. Brown algae, for instance, have a dry weight composed of 40% alginates, which can be blended with starches to create bioplastics. These organisms' photosynthetic machinery also makes them an ideal source of biomass feedstocks for biofuel. Additionally, cyanobacterial strains have been used for producing ethanol, isobutanol (a potential gasoline substitute), ethylene and isoprene.

As expected, bio-based materials face issues with scalability, as they require a significant overhaul of processes – these inefficiencies can negatively impact sustainability initiatives along the way. In addition, applications such as food packaging are still limited due to the poor performance of these materials in extreme conditions. The continued development of a robust bioeconomy is essential to the success of bio-based materials initiatives.

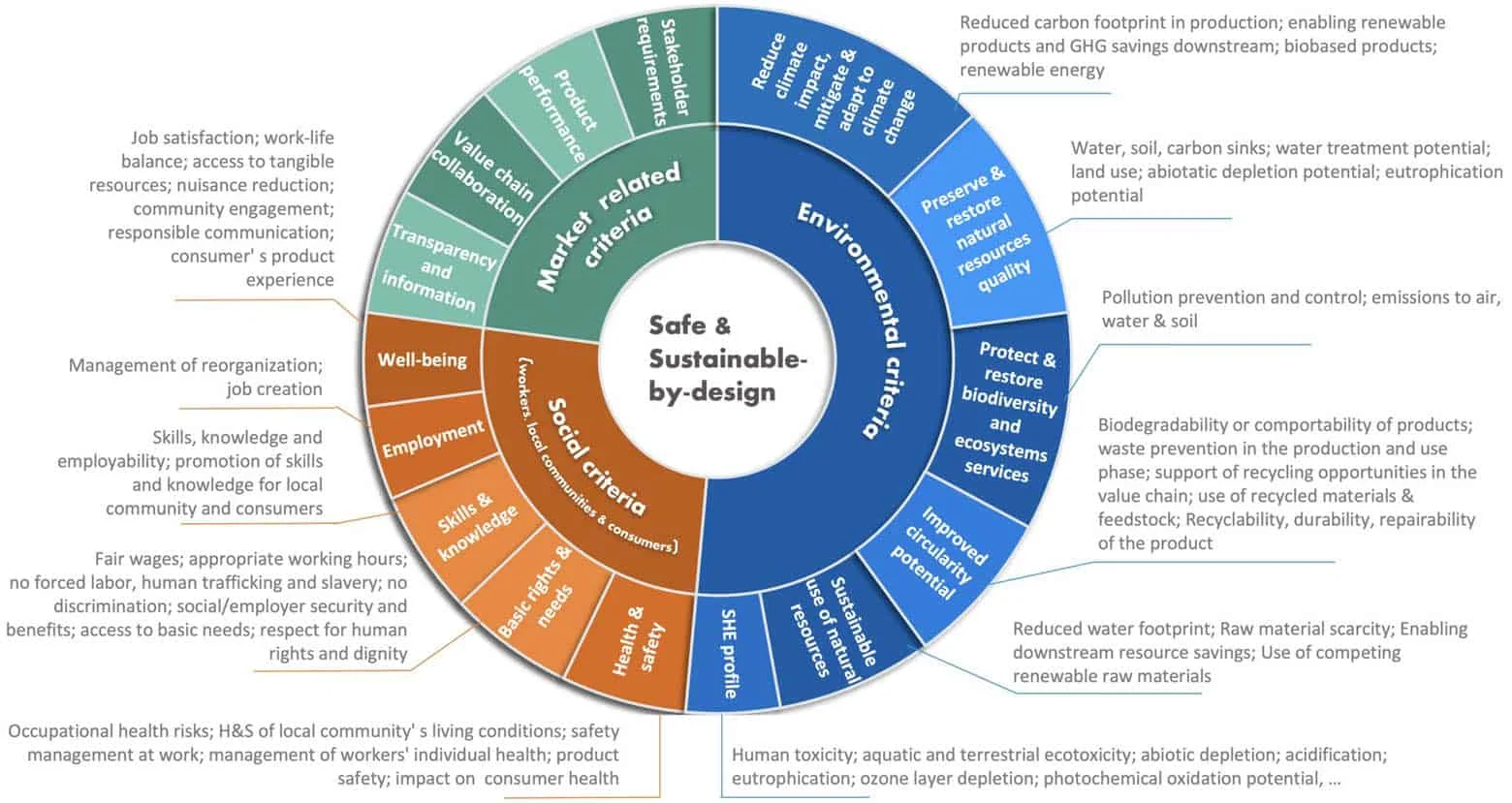

Safe and sustainable-by-design (SSbD) chemicals

In 2020, the European Commission published a chemicals strategy for sustainability that introduced the concept of safe- and sustainable-by-design (SSbD). It defined SSbD as “a pre-market approach to chemicals that focuses on providing a function (or service), while avoiding volumes and chemical properties that may be harmful to human health or the environment, in particular groups of chemicals likely to be (eco) toxic, persistent, bio-accumulative or mobile.”

This approach requires a lifecycle perspective and urges chemical producers to assess the environmental and human impacts of every stage of chemical development and usage.

While the SSbD framework is still a work in progress, the European Commission’s Joint Research Centre has recommended a two-phase approach for developing SSbD criteria. The first step focuses on four design principles:

Green chemistry — e.g., using waste as a sustainable feedstock

Green engineering — e.g., self-healing designs, such as concrete with bacteria that automatically fills in cracks

Sustainable chemistry — e.g., redesigning processes to create better products, such as genetically engineering microalgae to become a more efficient feedstock

Circularity by design — e.g., compostable food packaging that can be re-incorporated into the production cycle multiple times

The second step is an assessment of material and chemical hazards, human health and safety effects in the processing phase, human health and environmental impact in the use phase, lifecycle, and social and economic sustainability.

These steps align with the view of Cefic, the European Chemical Industry Council, which says any SSbD criteria must address environmental, social and economic factors and take a lifecycle approach.

Cefic’s map of SSbD criteria from the chemicals industry (Source: cefic.org)

Adopt SSbD across your product portfolio by identifying chemicals and processes that can be substituted with safer alternatives that emit fewer greenhouse gasses and allow for easier composting and upcycling.

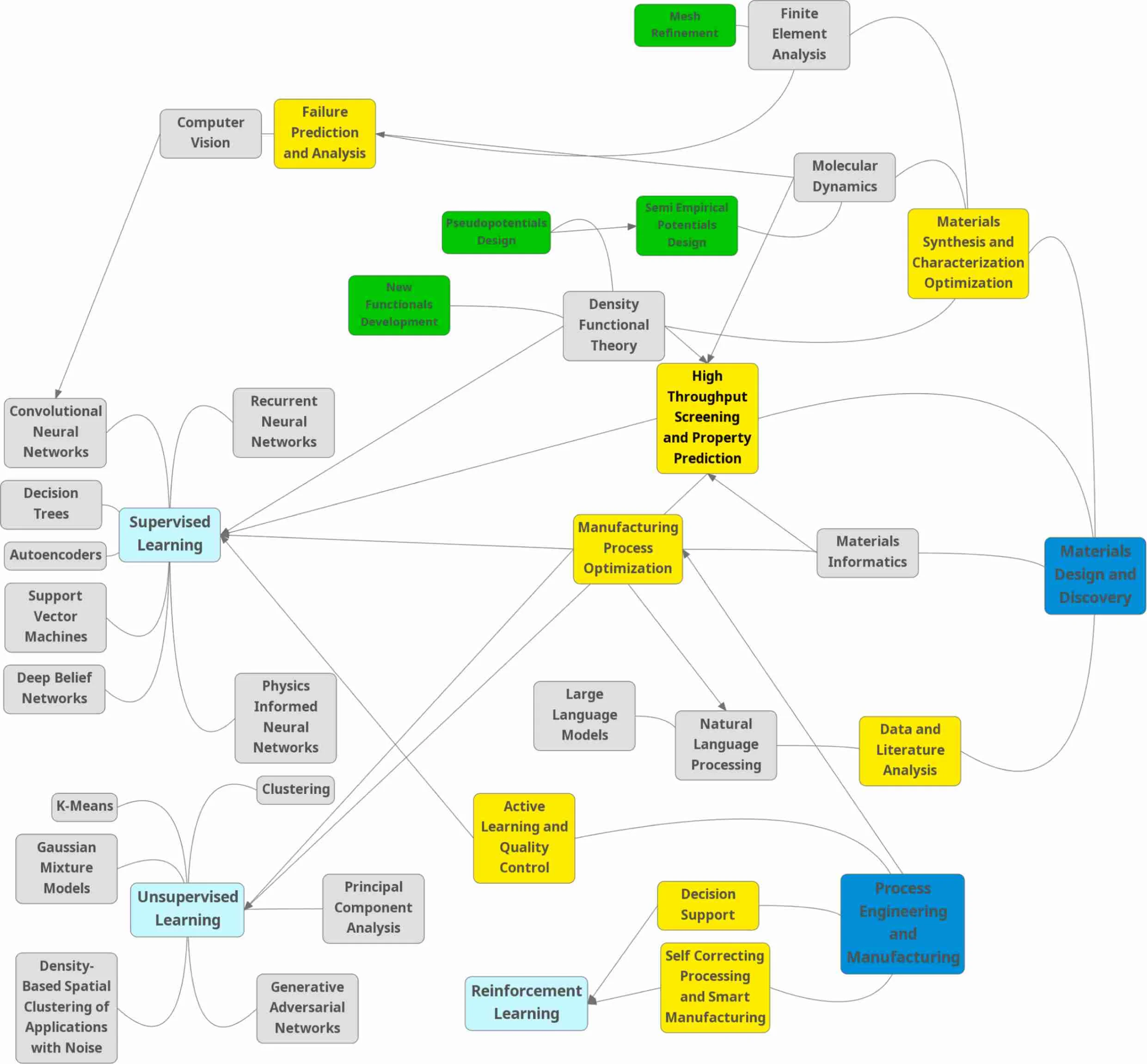

AI in chemicals R&D

Due to its ability to speed up R&D and cut prediction inaccuracy by about 50% , AI is now seen as a way to boost profit, productivity and sustainability in the chemical industry. Machine learning and predictive analytics can augment R&D efforts by identifying optimal synthetic routes for novel compounds, predicting unwanted properties, and forecasting material costs.

The energy and chemicals industries remain slower to adopt AI than other areas, which presents opportunities for organizations that wish to be on the leading edge. Chemicals R&D relies on access to relevant scientific data and market intelligence, and AI can bring significant time savings to these processes and fuel faster, confident decision-making.

Conceptual overview of AI/ML methods in Materials Science (Source: Computational Materials Science)

Materials discovery is one area where the potential of AI is significant. Using techniques such as machine learning, companies can quickly pull information from patents, proprietary data, published journals, scientific literature, public databases and industry bodies. Machine learning can also monitor innovation from other companies in the market for a competitive advantage.

In addition, using neural networks and knowledge graphs, chemicals and materials companies can:

Predict properties of new materials

Optimize existing materials or find new applications for existing materials (repurposing)

Identify new catalysts for chemical reactions

Reduce the number of iterations needed to design a new material or compound

Click here to download our ebook on AI and the materials development race.

Specialty chemicals

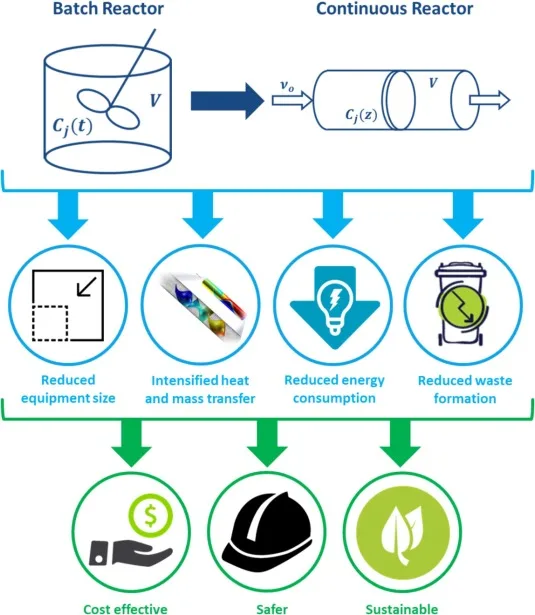

Chemical companies face continued economic challenges, though many began to see a significant bounce back in 2024. Many leaders continue to invest in decarbonization and innovation while looking to cut costs and increase their margins. High-demand, high-margin products like specialty chemicals are one such solution.

Specialty chemicals, also known as performance chemicals, are based either on single molecules or on formulations of mixed molecules. Specialty chemicals heavily influence the way a product functions.

Globally, the most in-demand specialty chemicals are electronic chemicals, specialty polymers, industrial and institutional cleaners, surfactants and flavors and fragrances, according to S&P Global. Demand will continue to rise, with the market size for specialty chemicals expected to grow from $641.5 billion in 2023 to $914.4 billion in 2030. Much of this demand will come from the need for construction, electronics, pharmaceutical and water treatment chemicals.

There is also an increasing demand for safe and sustainable specialty chemicals in electronics and consumer goods. For example, Apple has set its own regulations on specialty chemicals, which need to be followed in the production of its products. The Apple Regulated Substances Specification is publicly available and outlines how the company aims to remove harmful substances from the product life cycle.

Batch-to-continuous transition offers strong improvements to the production process. (Source: Chemical Engineering Journal, Volume 445.)

To improve profits in this highly competitive segment and become more valuable to your customers, invest in downstream opportunities like providing support services to clients and developing customized and novel formulations. This shift toward a more service-oriented approach also raises the entry barriers for competitors as it requires specialization and ongoing collaboration with clients.

Discover, innovate and develop with confidence

The key chemical industry trends for 2026 reflect a clear shift toward sustainability, smarter R&D and higher-value products. Success will depend on how effectively organizations align innovation, regulation and market opportunity across their portfolios.

Elsevier helps organizations navigate this complexity with a portfolio of solutions to support and optimize innovation outcomes. Enable faster, better decision-making across R&D initiatives with:

Trusted quality information, including peer-reviewed scientific literature, domain-specific data

Innovative technology that powers data transformation and analytical and predictive tools

Domain and data science expertise to solve complex problems with data solutions for R&D

Let’s shape progress together.

Sign up for the Industry Sustainability Insights newsletter

Sign up for a quarterly email update from Elsevier on the latest Industry Sustainability Insights, which spotlights hot industry topics, information on upcoming webinars, new articles and other resources.

Learn more about sustainable innovation with Elsevier

Read more insights into sustainable innovation and learn more about how Elsevier supports the world's leading engineering organizations.